Why plant-based chicken is about to take off

If social media feeds are any indication, 2019 was filled with success after success for plant-based meat. From Carl’s Jr. Super Bowl ad for the Beyond Famous Star burger to the Impossible Whopper leading Burger King to rapid sales growth, plant-based meat seems to be an unstoppable juggernaut.

Yet in the United States, plant-based meat still represents only about 1% of all meat sales in terms of dollars—and even less by volume.

Even more striking is just how fast per-capita animal-based meat consumption continues to rise, both in the United States and around the world. As reported by Food Processing last week, “Despite the popularity of plant-based products, 2018 was a banner year for meat consumption in the U.S., with consumers eating an average 222.4 lbs. of red meat and poultry per person that year compared to 216.9 lbs. in 2017, according to USDA. Preliminary 2019 data is showing another healthy increase.”

So what gives?

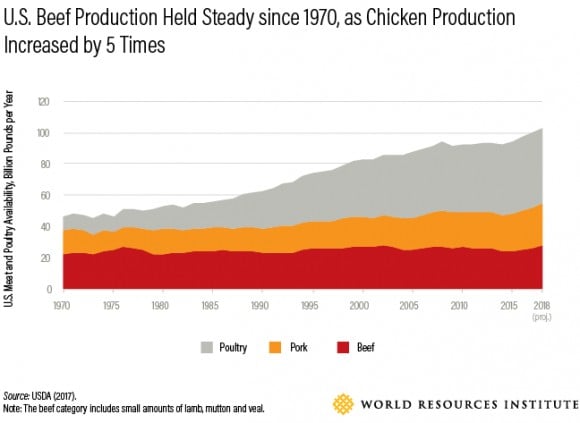

Most of this increase is coming from the continued relentless growth in chicken consumption. Over the past few decades, net beef production in the United States has held relatively steady, while chicken production has increased more than five-fold.

This rise in chicken consumption is being driven by its perceived benefits over beef and pork. Chicken is seen as a healthier form of lean protein, often marketed as a better alternative to red meats such as beef or pork.

Nutrition isn’t the only driver—price has also played a large role. According to the National Chicken Council, in 1960, wholesale beef prices were $0.60/lb. and chicken was $0.30, making beef 2x more expensive than chicken. In 2019, the wholesale cost of chicken had risen to $0.80/lb., but beef increased even more to $2.90/lb, making beef 3.6x more expensive than chicken for today’s buyers.

The success of the chicken industry has not come without harm. Poultry excrement creates significant land, water, and air pollution in communities across the US and around the world. The World Wildlife Fund notes the poultry industry uses most of the world’s feed crops. And although chicken is less carbon-intensive than beef, Leah Garces on Vox’s Future Perfect recently explained that “Replacing beef with chicken isn’t as good for the planet as you think.” The article notes that the greenhouse gas emissions per serving of poultry are 11 times higher than a serving of plant protein. A study in the leading journal Nature found the difference to be even greater. According to their review, poultry causes 40 times more global warming per calorie of protein—and 65 times more per calorie—than legumes.

Enter plant-based chicken

Plant-based chicken appears to be the perfect solution, harnessing the sustainability benefits of plant proteins and the widespread appeal of chicken-centric dishes. But, plant-based chicken hasn’t seen the same breakout success as plant-based burgers. Part of this is due to the taste and structural challenges of mimicking chicken: There usually isn’t a lot of flavor to mask off-notes, and the texture of chicken has been challenging for plant-based brands to match.

Another significant challenge for new plant-based chicken products is cost: while many consumers enjoy so-called “better burger” experiences and are willing to pay $10 or more per burger in certain higher-end dining settings, there are almost no similarly premium chicken dishes or products. It is simply more difficult to compete on price with chicken than burgers — it’s hard to imagine consumers lining up to buy $15 batches of plant-based chicken nuggets. This means that plant-based companies not only need to enter the market with a tasty and texturally familiar product, but they also need to match an incredibly low price point, something only possible with a production process that can rival conventional chicken’s economies of scale.

Preparing for liftoff

But there are signs of progress. Throughout 2019, a variety of restaurants around the world have added or tested plant-based chicken options, and each new option has met with great success. The most famous has been KFC’s test in Georgia earlier this year. Long lines led the restaurant to shut down the drive-through, and they still sold out in hours.

KFC Canada also sold out of their plant-based chicken in mere hours. A&W is having similar success. KFC UK launched its plant-based chicken in June, and it also sold out faster than expected. A wave of new and upgraded plant-based chicken products are coming to market from large players like Nestle, Beyond Meat, Morningstar Farm, and Lightlife, while startups such as Rebellyous, Improved Nature, Worthington, and Alpha Foods are entering the market with exciting new offerings.

Plant-based chicken couldn’t come along at a better time. Chicken has become a fiercely contested segment in the US restaurant industry. The surging popularity of chains like Chick-fil-A, Zaxby’s, and Raising Cane’s has prompted high-profile chicken launches and product refreshes from chains like KFC, McDonald’s, and Popeye’s. Plant-based chicken could be a way for restaurant chains to find new competitive advantages.

Chicken made from plants could also help bolster chain restaurants’ appeal to younger generations. Millennials are becoming parents and are looking to feed their young children the same foods they eat, including lots of plant-based proteins. Conversely, comforting and snackable foods originally targeted at kids (nuggets & tenders, pizza bites, breakfast cereal, etc.) have become nostalgic foods for adults. Plant-based chicken nuggets and tenders would be well-positioned to take advantage of this convergence of adult and kid foods.

Plant-based burgers get most of the attention today, but plant-based chicken is on track to be the next breakout category. When this happens, plant-based meat will reach new consumers and grab an even bigger share of the market. The resulting benefits will be tremendous—we can’t wait!

Header image credit: Tofurky